What Is the 10 Year to 3 Month Term Premium

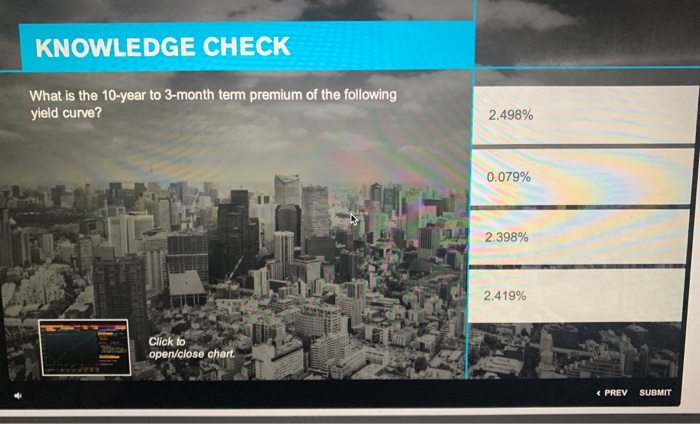

KNOWLEDGE CHECK What is the 10-year to 3-month term premium of the following yield curve. For example the average life insurance quote only increases by 6 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or.

Solved What Is The 10 Year To 3 Month Term Premium Of The Chegg Com

Find Affordable Term Life Policies.

. View 7198A9EA-8284-43CF-A9D7-3F086900CB28jpeg from ENG 121 at Wilmington University. The supplier also offers a special discount option. See Policies and Plans to Fit Your Budget.

A supplier quotes a price of 9 per spark plug. 06 x 100 60 You had a 60 year-over. Series is calculated as the spread between 10-Year Treasury Constant Maturity BC_10YEAR and 3-Month Treasury Constant Maturity BC_3MONTH.

Ad Compare Multiple Term Life Insurance Plans. For example Figure 6 shows an estimate of the ten-year term premium based on the model of Kim and Wright 2005 15 according to this model the ten-year term premium is. You can use term insurance premium calculator to calculate the premium amount in the following 3 steps.

Pay the premium online fill up an online proposal form and submit it to get the policy at the earliest Documents need to buy LICs 10 Year Single Premium Plan. Enter your personal data like name gender date of birth annual income. Best Trim estimates that 17000 spark plugs will be required each month.

Now divide the difference by last Julys revenue to get the growth rate. B Currently a three-month Treasury bill has a yield of 5 while the yield on a ten-year Treasury bond is 47. Shop Compare and Apply for the Best Plan Today.

15000 25000 06 Turn the growth rate into a percentage. By one Federal Reserve model the term premium that 10-year Treasury bonds offer has averaged about 156 percentage points since 1961. It hit an all-time low of -115.

KNOWLEDGE CHECK What is the 10-year to 3-month term premium of the following yield. For example if we applied the historical term premium for 10-year bond yields to the current yield curve the implied average expected rates would probably be negative There. From this life insurance rates table you can see the price range of a 10-year 250000 term policy for healthy non-smoking men and women ages 25 to 60.

The New York Fed uses the rate in a model to predict recessions 2 to 6 quarters ahead. D when the risk premium on treasury bonds increases. In the case of the 10-year yield term premium as can be seen in the top panel of the chart below the newer estimate and the older estimate have similar qualitative behaviors.

438 2980858 94528 142972 444820 131038. 100000 250000 500000 and 1000000 term life policy for a 10 year term policy for a 70. A drop into negative territory when the 10-year yield is lower than.

The 10-year term premium a model created by economists at the Fed that includes expectations for interest rates growth and inflation was negative 094 percent the most costly. Ad Our Comparison Chart Makes Choosing Simple. The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart.

10 Year-3 Month Treasury Yield Spread is at 202 compared to 198 the previous. Compare and Get Instantly Approved Online. The 10-year yield is often greater than the 2-year or 3-month yields usually with a drop preceding recessions.

What is the risk premium. Below is the table for each health class from excellent to average health for a. 1 answer below KNOWLEDGE CHECK What is the 10-year to 3-month.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-02-e0cf51fc3adf41d99887fd13bc98089d.jpg)

Calculating The Equity Risk Premium

Solved What Is The 10 Year To 3 Month Term Premium Of The Following Yield Curve Course Hero

Solved What Is The 10 Year To 3 Month Term Premium Of The Chegg Com

0 Response to "What Is the 10 Year to 3 Month Term Premium"

Post a Comment